Kasturi and I were started working as team for this rotation. Our first concepts were:

Concept 1 – Gamified Financial Literacy from School Level

What

A system of teaching financial management to students from a young age through gamification.

Students would randomly be assigned a certain amount of ‘money’ (a metaphor for money would be used, not real money) which would form the basis of their total ‘net worth’. From this total amount, students are to carry out their daily school expenses – like returning books to the library would earn them some points while failing to return books on time would result in deduction of their ‘money’. More such instances could be identified where this system could be implemented on a regular basis.

The financial history of all students would be publicly accessible. Students could get together and analyse their own and others’ data to understand how money works. They could have discussions about class divide, money management, needs and wants, and practices that would better utilise the money they have and increase their chances of multiplying their ‘net worth’.

There could be different levels in this system, starting from a very basic understanding of things the students own (from the first grade) to complex concepts like taxation (in middle school) to investments and trading (in the 11th and 12th grade).

Where

Implemented in schools across the world. The way each school develops this system could be different based on how they believe finances should be managed. Should a system be capitalist or communist? This could even depend on personal preferences.

When

Starting from the very beginning of school education on a micro level and developing it into a complex and large scale model by the end of a student’s schooling.

Who

From young children to young adults.

Why

To instil concepts of financial management, a very important subject in the life of a person, from early on in their life. To be able to talk about finances easily and to be able to fit into society as an adult due to their adequate knowledge of finances.

How we got there

- What if financial literacy and management was taught from school level and what if diversity was celebrated rather than discouraged?

- What if everyone’s financial history was publicly known?

- What if more expensive and branded products made us look uncool or less popular?

- What if financial management was straightforward, commonly known, and easy to talk about?

- What if staying on budget was discouraged?

Concept 2 – Financial Decision Exchange – A scary way to understand each other’s financial management techniques

What

A group of people interested in learning financial management come together. Everybody is responsible for managing somebody else’s finances. A Subject (the person whose finances are being used) is paired with a Guide (the person who is making their financial decisions).

These pairs or groups come together, for instance, they could go on a one-day trip. On this journey, each Subject would be liable to all the financial decisions that their Guide makes. This could facilitate discussions between the Subject and Guide about the factors that influence those decisions. It could lead to a better understanding of how the Guide is used to making decisions, how the Guide’s understanding of the Subject is influencing the decisions, and how the Guide could better design a financial system that would suit the Subject.

Where

This crux of this concept could be implemented across the globe. Specifics like the exact role of the Guide and Subject could be changed according to the aim of the group.

When

Could be adapted in different time frames. Groups could begin this activity on a smaller scale, like for a few hours, and gradually increase the time.

Who

This concept would ideally work for adults who already have some understanding of their financial standing but would like to improve on it.

Why

To understand how others manage their finances and to facilitate discussions about financial management among people from diverse backgrounds. This would help in understanding people around us better and to be able to forge connections and fit in.

How we got there

- What if a third person decided my needs and wants? How would it affect my financial perceptions?

- What if my finances were sorted and managed by the government or some authority figure? What if I were to strictly follow their suggestions?

- What if we weren’t responsible for the amount of funds we have?

Concept 3 – Paper as currency

What

An institution (like LCC) could come up with a day (announced randomly) where money wouldn’t be used. Instead, something that’s perceived to be invaluable would be used in place of money (paper, for e.g.).

Where

Smaller and controlled environments like a college would be ideal for this type of an experiment. Other places could be a coffee chain, library, classroom, etc.

When

Once in a long time, probably a year.

Who

Organised by the managers/owners/stakeholders of the institution. For the members of the institution.

Why

To question the value of money and to question the value of objects that are generally perceived as invaluable. How does our perception of these objects change through this exercise? Such an experiment would shift the dynamics of financial discrepancies and lead people out of their usual habits to explore a new aspect of financial management, talk to new people, discuss new topics, and fit in better.

How we got there

- What if money wasn’t a measure of finance? What else could be it?

- What if there was no value attached to money?

Concept 4: Social Walking App for Saving Money and Making Connections

What

A social walking app that helps users save money, make new friends, and stay fit by walking to nearby destinations. Users select a tourist attraction or landmark they’d like to visit and are matched with others who want to walk there too. As they walk together, they save on transportation costs, engage in conversations, and build social connections. The app tracks their time walking and creates a “connection chat” with a streak feature that records how many minutes they’ve walked with each person, encouraging repeat walks and stronger connections.

Where

The app can be used globally, especially in big cities where public transportation is expensive, like London or New York. It’s ideal for newcomers, tourists, and residents who want to explore cities while connecting with others.

When

Perfect for people new to a city, tourists, or anyone looking to save money on transportation, stay active, or meet new people.

Who

Targeted at students, professionals, tourists, or anyone feeling isolated or seeking affordable ways to explore and meet people.

Why

The app helps reduce transportation costs, encourages social connections through shared walks, promotes health via walking, and fosters long-term friendships through the streak feature.

How

- Select a Destination: Users choose a nearby place they’d like to visit.

- Connect with Others: They are matched with others who want to walk to the same location.

- Walk and Talk: The app tracks the time spent walking, creating a chat and streak for each connection.

- Fitness and Savings: The app logs steps, calories burned, and transportation money saved.

Challenges

- Safety Concerns: Verified profiles and location-sharing options for safer connections.

- Time Constraints: Flexible route lengths to fit different schedules.

- Low-Density Areas: Suggested times for walks to boost participation.

How we got there

- We have had personal experiences where going on walks with friends or planning to go to gym together has helped to keep us motivated to be consistent has helped improve connection with that person.

- We thought about adding a financial perspective to it to save on money as well.

Concept 5- Financial Wellness App and Safe Space for Emotional and Practical Support

What

An app and offline community that provides a safe space for people to openly discuss financial struggles, share their emotional burdens around money, and offer support. The app allows users to share tips and tricks on managing money, from both psychological and practical perspectives, which are stored in a searchable database. When a user faces a financial issue, the app provides problem-specific solutions based on the collective advice. Offline sessions also create a supportive environment where users can share their experiences without fear of judgment, fostering a close-knit community.

Where

The app works globally online, while offline sessions are organized locally in cities and towns. These sessions offer a safe, judgment-free space for people to meet and discuss their financial and emotional concerns. It’s particularly useful in places where financial stress is common but often goes unspoken due to social stigma.

When

The app is useful anytime users are struggling with financial management, emotional stress about money, or seeking practical advice. The offline sessions could be held weekly or monthly, creating a regular platform for support.

Who

The app is targeted at anyone facing financial stress or emotional difficulties related to money, whether they are students, professionals, or families. It is designed for people who want a supportive community, and for those who have tips and advice to share.

Why

Financial issues are often emotionally taxing, yet people hesitate to talk about them due to societal judgment. This app offers:

- Emotional Relief: A safe, non-judgmental space to discuss financial fears, frustrations, and struggles.

- Practical Support: A user-generated library of tips and solutions for common financial problems.

- Community Building: Offline sessions to promote real-life connections and support, building a stronger sense of belonging.

How

- Share Issues and Tips: Users can share their personal experiences and helpful tips regarding financial management, both practical and psychological.

- Database Search: When users face a specific financial challenge, they can enter it into the app, and it will suggest relevant advice from the community-driven library.

- Offline Sessions: Regular in-person meetings provide a platform for deeper emotional sharing, offering a sense of belonging and support.

- Community Growth: Users can engage in discussions, provide encouragement, and help others without fear of judgment.

Challenges

- Privacy Concerns: Implement strong privacy features, like anonymous posts or encrypted conversations, to protect sensitive information.

- Access to Offline Sessions: Ensure that offline sessions are inclusive and accessible to diverse communities by offering virtual participation options.

- Maintaining a Positive Environment: Active moderation and community guidelines to prevent negative behavior or judgment.

How we came up with it

We found that it’s assumed that ‘One can’t acknowledge financial discrepancy sometimes’ and while questioning it we thought what if there was a specific safe space dedicated to talk about financial distress.

Concept 6: Museum of Overvalued Things (Virtual Reality)

What

The Museum of Overvalued Things is a virtual reality platform where users can “preserve” items they feel they overspent on, but still attach emotional value to. Users can take a picture of the item and place it in a virtual glass case in the museum, along with a small description explaining why they found the item valuable despite overspending. Other users can explore the museum, read descriptions, and leave comments about whether they believe the purchase was worth it. This interactive experience helps individuals process post-purchase dilemmas by validating their feelings or offering new perspectives.

Where

Accessible globally through a VR app, the museum provides users from all over the world a virtual space to showcase and discuss their overvalued purchases. It’s particularly appealing to people who struggle with buyer’s remorse or financial guilt.

When

This concept is useful when users feel conflicted about a purchase or need to work through their emotions related to overspending. The museum acts as a place of reflection and discussion, available anytime a user wants to process or validate their purchase decisions.

Who

The app targets anyone dealing with post-buying dilemmas or those interested in exploring the emotional impact of their spending habits. It’s especially relevant for individuals who tend to spend emotionally or feel guilty about purchases but still attach sentimental value to the items.

Why

People often struggle with the conflict between spending money on unnecessary items and the emotional or personal value they attach to those items. The Museum of Overvalued Things offers:

- Emotional Processing: A safe space to reflect on why they value certain items despite overspending.

- Community Validation: An opportunity for others to engage with and validate their emotional attachment to purchases.

- Support for Financial Decisions: Reading others’ experiences can help users manage their feelings of regret or satisfaction regarding purchases.

How

- Submit Overvalued Items: Users upload a photo of an item they overspent on, along with a description of its emotional or practical significance.

- Display in Virtual Museum: The item is placed in a virtual glass case within the museum, accessible for other users to view.

- Community Engagement: Visitors can explore the museum, read descriptions, and comment on whether they feel the purchase was justified.

- Support Network: The museum fosters a community where users can reflect on spending habits and find comfort in shared experiences.

How we came up with it

- Many times people buy something which is valuable for them but overthink later if it was really worth it or not

- This puts them in bad emotional state and many times when our purchase is validated by someone else it gets us out of that dilemma

- We thought what if there was museum of all such things which people bought but regretted getting later

- Take the concept of investing time, energy, emotional energy (in the context of the wellness app) and turn it into the real concepts on investment

Reflection (13th Nov. 2024)

The brief for Rotation A seemed quite straightforward on the first day. I wouldn’t say that after having finished the class.

Looking back at the work we aimed to produce, some words that come to mind are novelty, innovation, unconventionalism, surprise, and value. There is still a long way to go to achieve those in my propositions and I certainly realise the conventionalism that my brain is trained to lean towards.

I see a change in the way that I understood the topic and the solutions that we were to come up with within the four weeks that I’ve worked on this project. I realise the importance of coming up with ideas that are simpler, specific, and creative. Mental health, financial discrepancies, and inequality are, as pointed out in my feedback sheet, topics that cannot be solved. The interventions that I come up with need to address a part of the issue and make the experience of people facing these issues better. I am beginning to keep the ultimate purpose of the exercise in mind with every passing iteration and trying to not get distracted by the smaller details that don’t matter as much as the issue I’m trying to address.

While the topic and its deliverables get clearer to me, I cannot help but think that the more I get involved in the idea generation and research of this topic, the more ‘wicked’ the topic gets. I suppose that is the purpose of this Rotation.

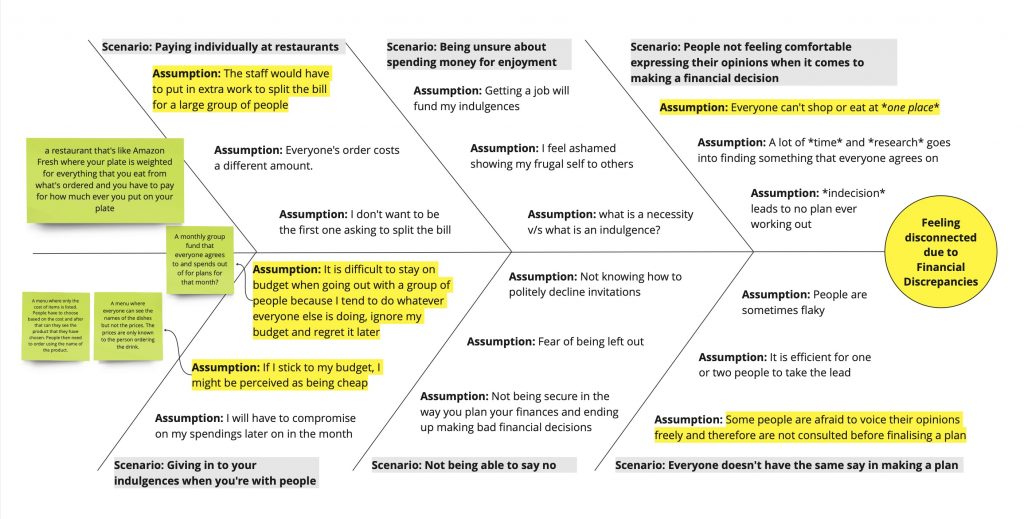

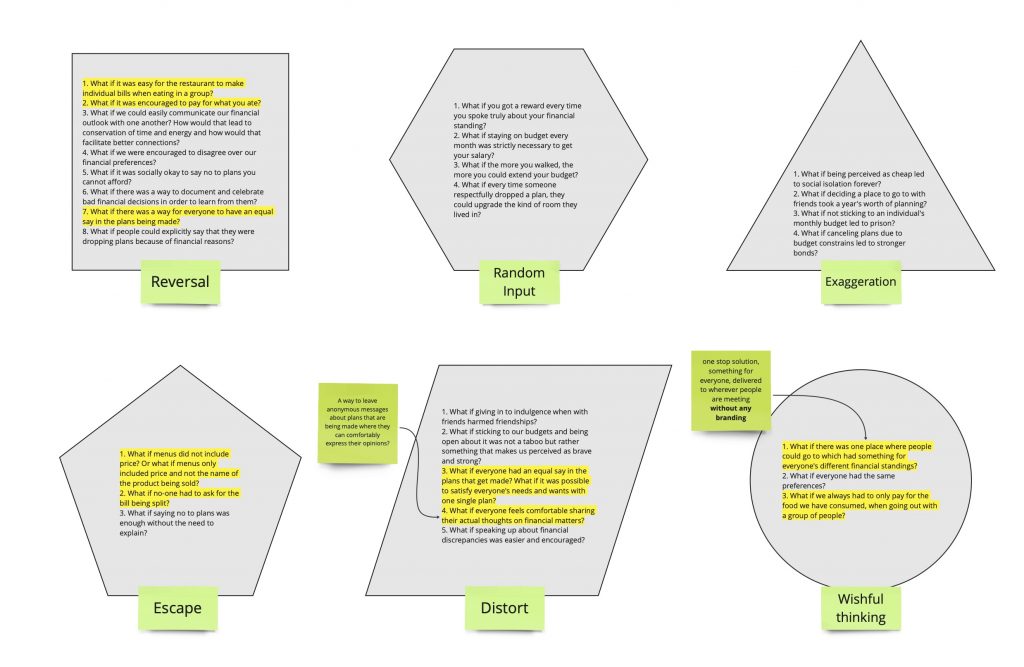

What helped me most with the ideas that I have generated thus far was to generate scenarios where my issue becomes most relevant for my target audience. These scenarios became the causes in my fish-bone map, which helped generate assumptions for the Lateral Thinking exercises. This approach, suggested by Paul during my tutorial, has helped me streamline my thought process and design thinking process into producing concepts that are innovative yet not completely bonkers. This is important because all the previous iterations of my ideas eventually turned into torture mechanisms, and while they did address the issue, they would really be impractical and unhelpful in the real world. The goal with this Rotation is to not only come up with concepts that address the issue, but also, to impact the people involved in a positive manner.

At the moment, I am synthesising my feedback into actionable points that can steer my ideas in the right direction. I am sure there are more realisations about the brief to come and I will keep updating this space with more of those. Bye till then!

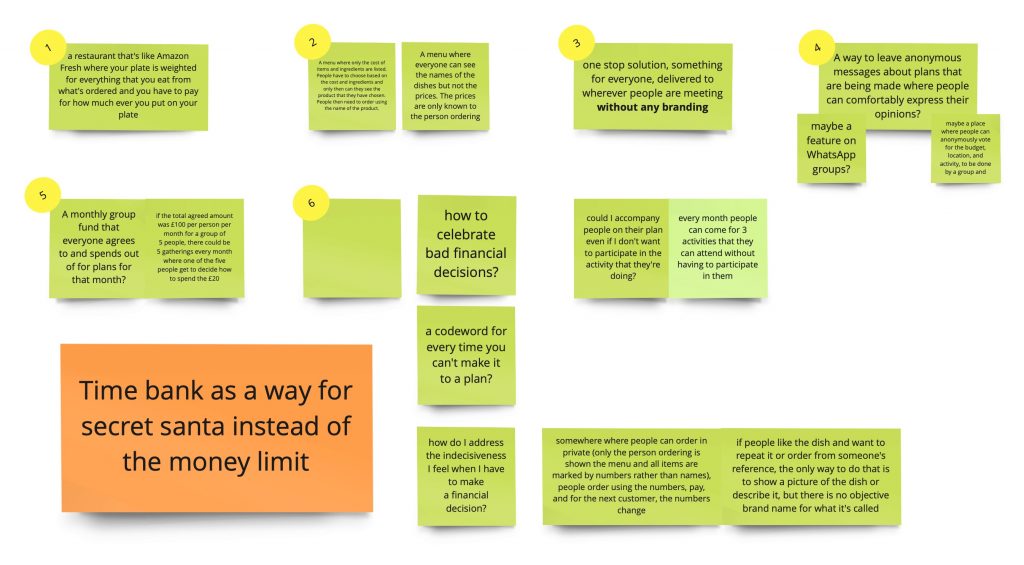

Process for the final concepts:

Feedback from Review Week:

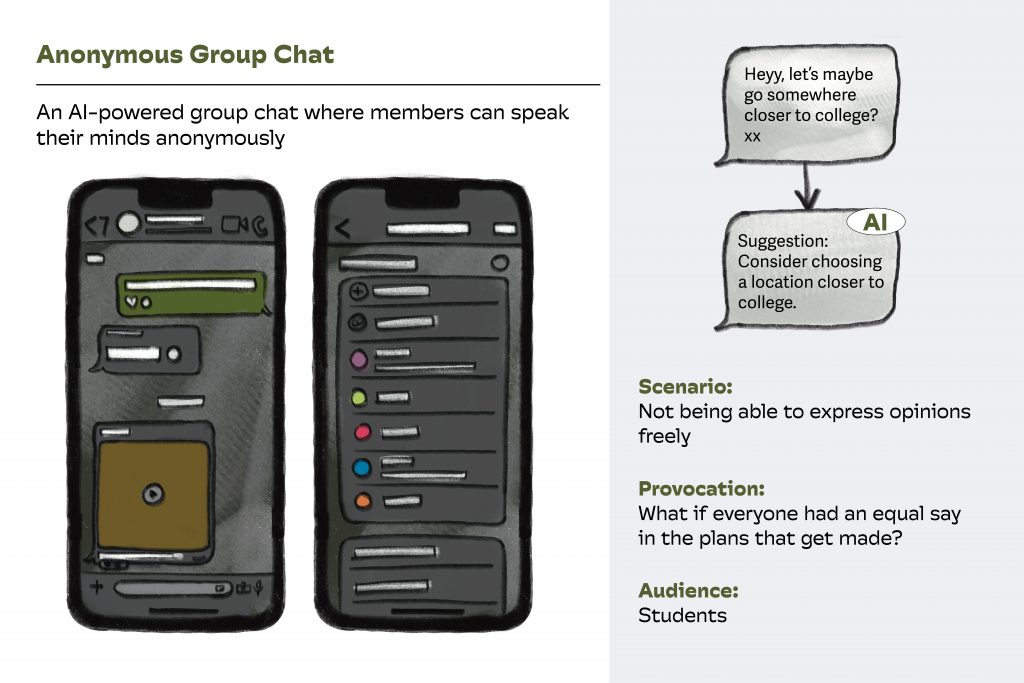

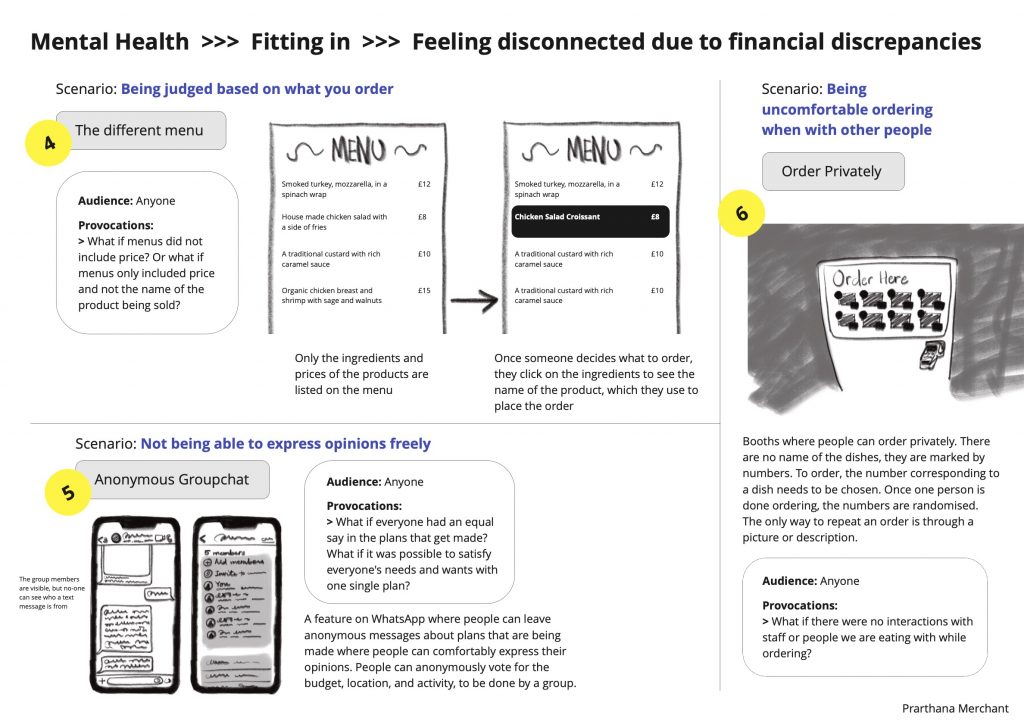

- Anonymous GC – AI could intervene so that the way people type doesn’t give away anonymity

- Develop more original ideas about tech/platform solutions

- Explore idea 1 – the restaurant table design further

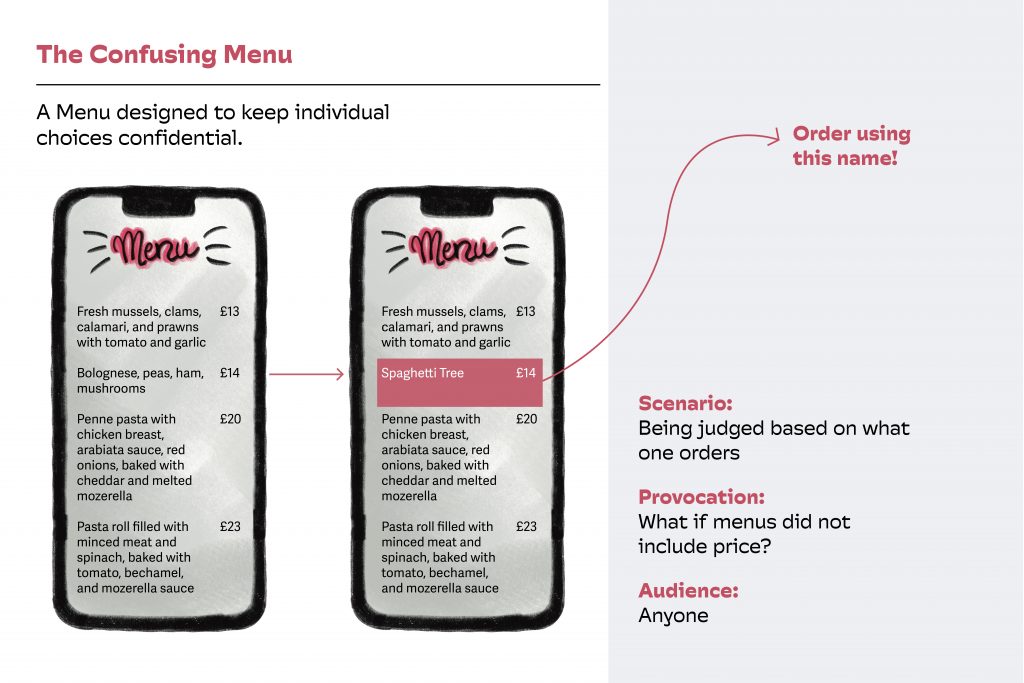

- Explore menu organised by price more. Think clearly. What problem am I exactly trying to tackle and how?

- What can be done to address inequality? Can it easily be solved or addressed?

- Rethink the problem. Clearly state it. And then think of ways of resolving it.

- Get back to lateral thinking

- Some ideas feel generic

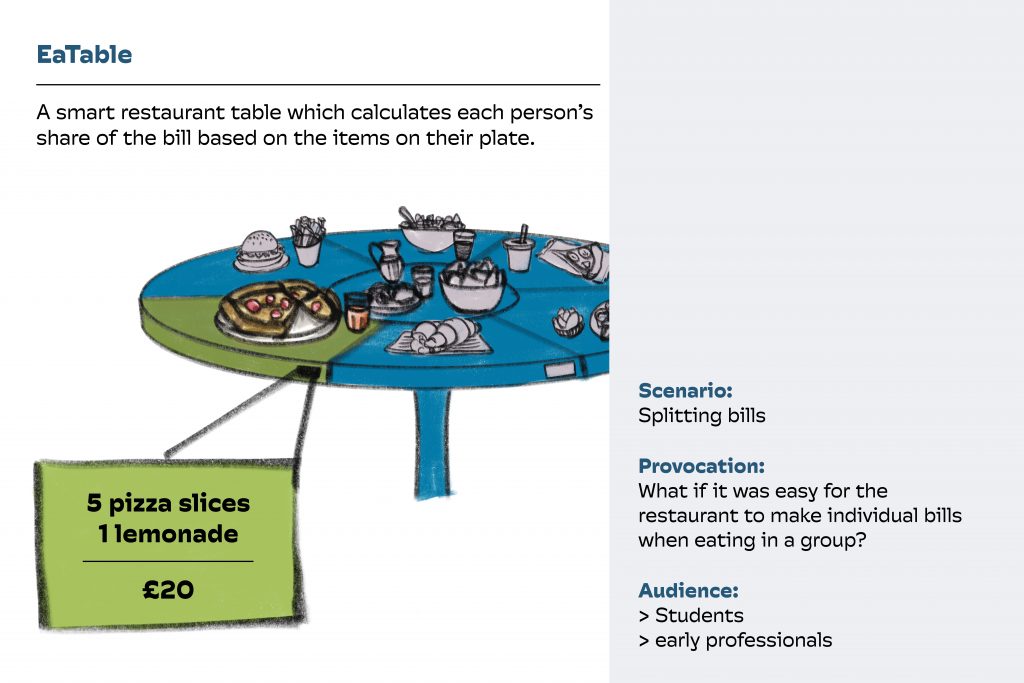

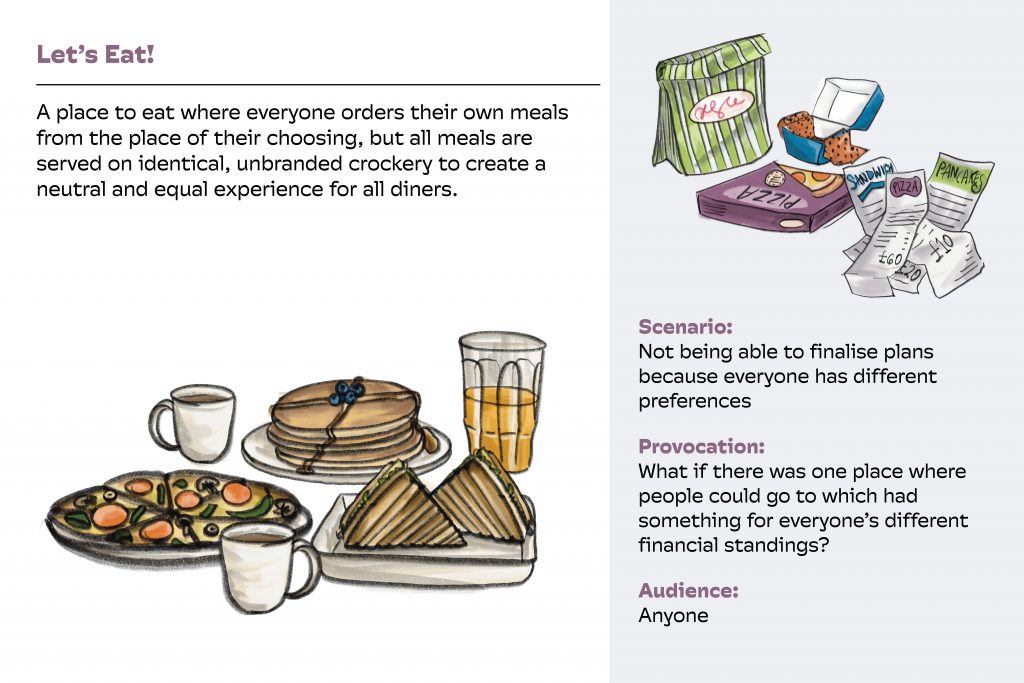

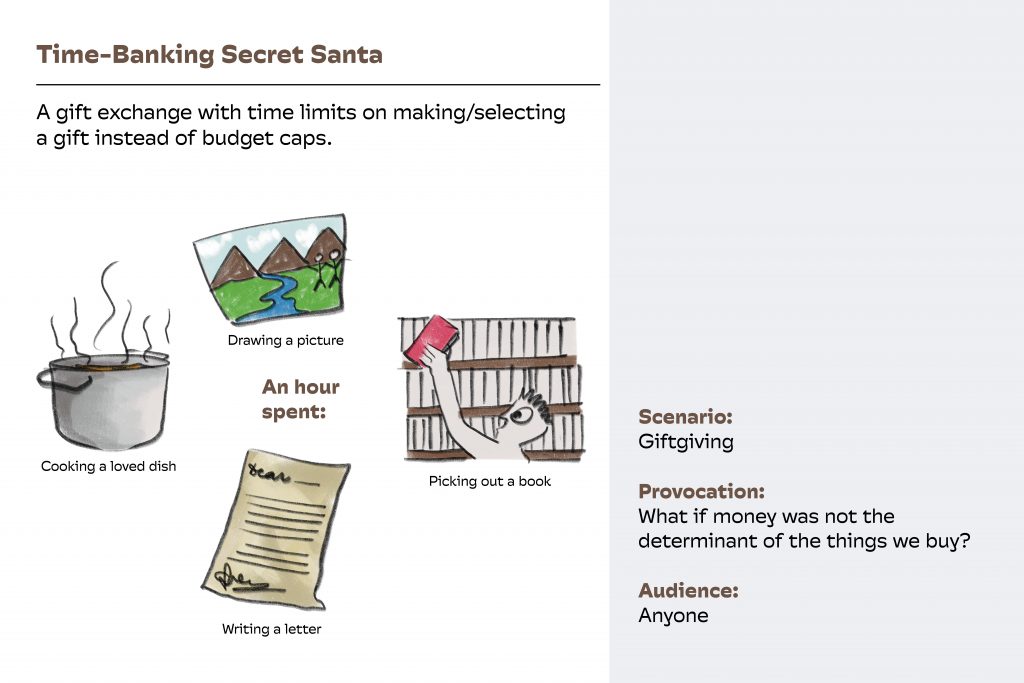

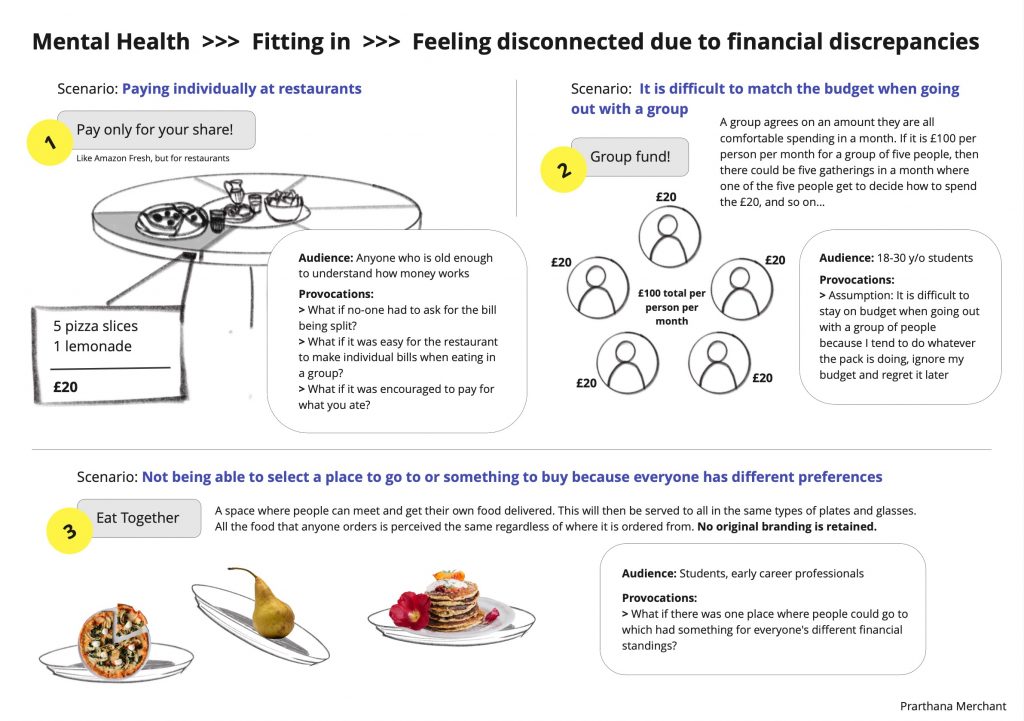

Final Concepts: